FY25 is expected to see an accelerated double-digit growth for DDL, thanks to a pick-up in domestic milk volumes, commencement of a new plant in Kenya, and a massive increase in cattle feed capacity

Outlook for DDL in FY25

Robust Growth Expected

FY25 is poised for accelerated double-digit growth for DDL, driven by increased domestic milk volumes, the launch of a new plant in Kenya, and a significant boost in cattle feed capacity.

Milk procurement prices are projected to remain stable this fiscal year, thanks to steady input costs. Combined with enhanced operating efficiencies and a greater focus on value-added products, this stability is expected to support strong double-digit margins for DDL.

With a solid balance sheet and strong cash flow generation, DDL is well-positioned to explore inorganic growth opportunities.

DDL stands out as one of the few high-quality listed dairy companies, boasting a track record of industry outperformance, a reputable brand, and an experienced management team. Since our recommendation in October 2023, the stock has delivered a robust 44% return, compared to the Nifty 500 index’s 25% return in the same period. We maintain our positive outlook on the stock.

March 2024 Performance

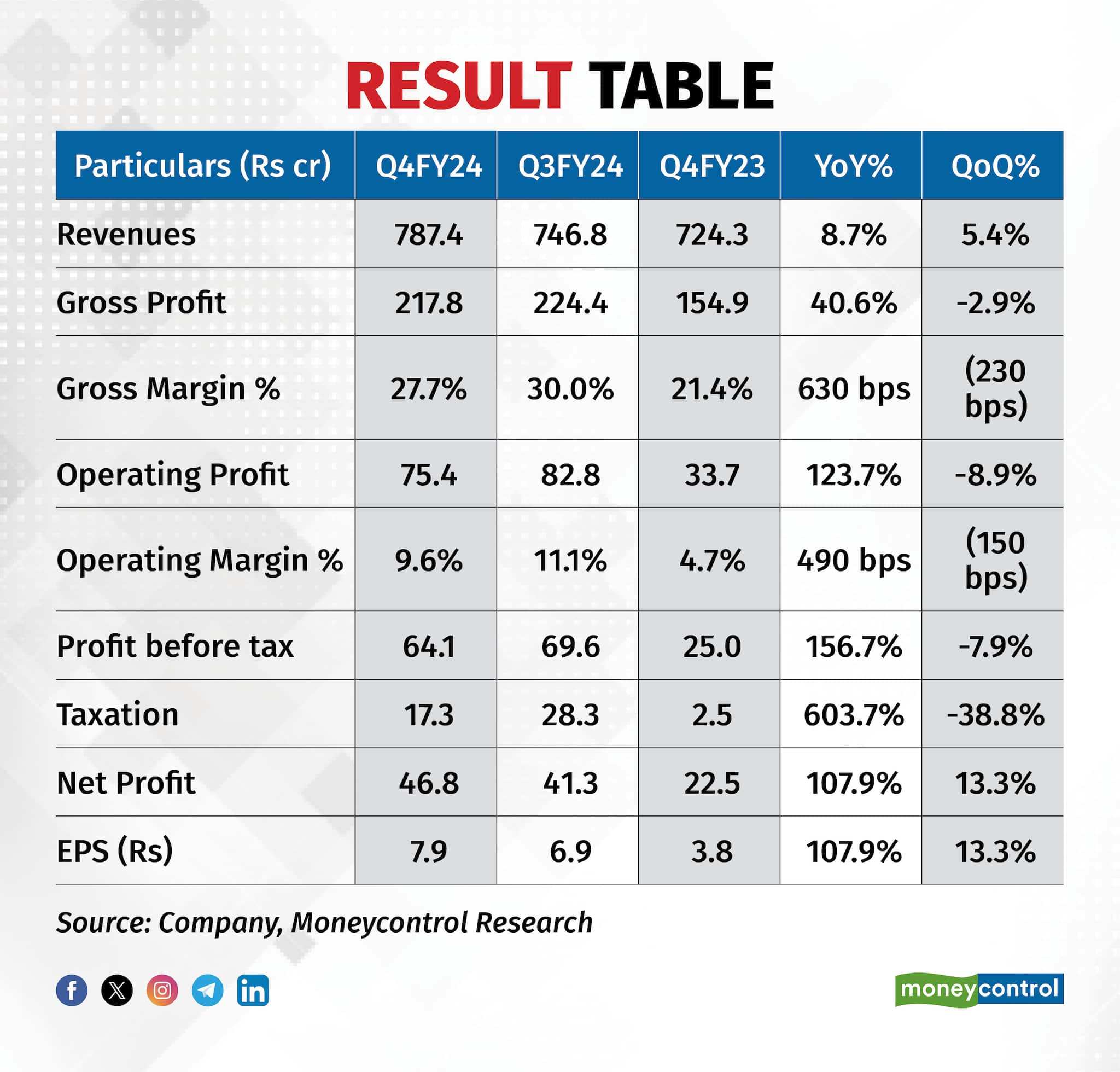

Revenues grew by 9% year-on-year (YoY). While milk sales volumes remained flat YoY, growth was driven by better sales realizations and an increase in value-added product (VAP) sales. VAP sales surged by 19% YoY, raising their share of total revenues to 29% (a 300 bps YoY increase) in Q4FY24.

Gross margins improved by approximately 600 bps YoY, benefiting from lower raw material prices during the flush season and higher VAP sales. DDL recorded an inventory write-down of about Rs 23 crore in Q4FY24 to reflect the net realizable value.

Excluding the write-down, gross margins would have been about 300 bps higher. EBITDA margins improved by 490 bps, slightly less due to increased employee and advertising expenses after commissioning new plants. Net profits more than doubled

Growth Momentum to Continue

DDL expects to maintain double-digit growth, forecasting a 12-15% increase for the current fiscal year. Despite flat liquid milk sales volumes in India last fiscal year due to steep price increases, DDL anticipates mid-single-digit volume growth this fiscal year.

In Q4FY24, DDL started its new dairy plant in Kenya, Africa, with a capacity of 1 lakh liters per day, which will drive growth momentum. Additionally, DDL increased its Orgafeed (cattle feed) capacity five-fold to 480 MTPD (metric tonnes per day) last fiscal year, which will further boost growth. DDL plans to liquidate the inventory built up towards the end of the last fiscal year, primarily fat and milk powder, as inventory days increased from 15 days in FY23 to about 45 days in FY24.

Margin Improvement

DDL expects stable milk procurement prices this fiscal year, which should aid margin improvement. While there was a slight increase in procurement prices in FY24, DDL anticipates a continued rise in the share of high-margin value-added products like curd, ice creams, and buttermilk, further enhancing margins. Inventory levels are expected to remain steady at about 45 days, with no anticipated inventory write-downs. We have factored in about a 60 bps YoY improvement in EBITDA margins for FY25.

Strong Balance Sheet for Inorganic Growth

DDL remains a net debt-free company, with cash and cash equivalents of approximately Rs 300 crore as of March 2024. The company’s strong cash flow generation capabilities, with expected cash flow from operations around Rs 300 crore in FY25, provide the financial strength to pursue inorganic growth opportunities. Historically, inorganic growth has been a key component of DDL’s strategy, enabling it to outpace the dairy industry.

Valuations

At the current market price (CMP), the stock trades at a P/E ratio of 22 times FY26 projected earnings. We recommend investors to add the stock.

- Source: Mony control