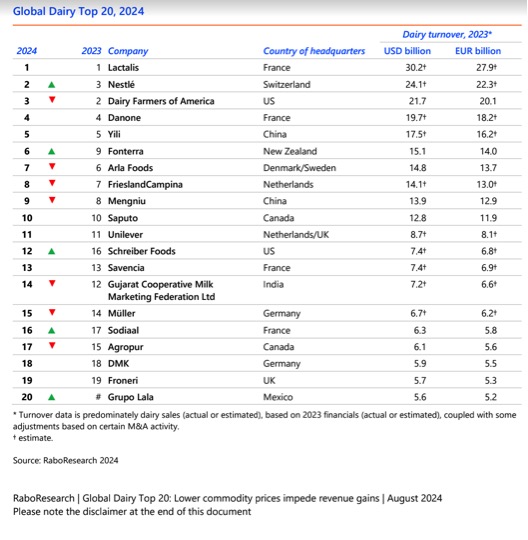

Taste of India Amul brand has stepped down by two spots in the latest Rabobank Top 20 Global dairy list for 2024

Revenue Overview: Modest Gains Amid Lower Prices

RaboResearch’s Global Dairy Top 20 report for 2023 highlights a modest 0.3% increase in combined turnover for the top global dairy companies in US dollar terms, following an 8.1% rise the previous year. Lower milk prices in 2023, compared to 2022, significantly slowed revenue growth. In euro terms, combined turnover declined by 2.3%, impacted by the stronger euro against the US dollar and weaker revenues among key European cooperatives. Less than half of the companies maintained their positions from the previous year.

M&A Activity: Anticipated Deals Could Shift Rankings

In 2023, the dairy sector saw limited M&A activity, continuing the trend from the previous year. Notable exceptions include Danone’s divestment of its Russian business and Horizon Organic and Wallaby brands, which contributed to its revenue decline. However, upcoming deals from companies like Unilever, Fonterra, and General Mills could significantly impact future rankings as these firms re-align their core business strategies.

Top 10 Performers: Changes in Rankings

Lactalis became the first dairy company to surpass $30 billion in annual revenue, maintaining its top position. Dairy Farmers of America (DFA) dropped to third place due to lower revenues, while Nestlé reclaimed the second spot with continued growth. Chinese dairy giants Yili and Mengniu held their positions in the top 10, though their rankings were slightly affected by unfavorable exchange rates.

Investment Trends: US vs. Global Markets

While M&A activity remained subdued, US dairy companies focused on internal growth, with an estimated $7 billion in investments in new plant construction and expansions from 2023 to 2026. This contrasts with global trends, where stagnant or declining milk production has led to plant closures, particularly in Europe and New Zealand.

New Entrants and Departures

Mexico’s Grupo Lala entered the Global Dairy Top 20 for the first time, driven by organic growth and a strong Mexican peso. Ireland’s Glanbia, which debuted last year, exited the list due to declining dairy-related revenues.

Outlook: Challenges and Opportunities Ahead

The coming years will likely see increased M&A activity as dairy companies reexamine their priorities. Economic uncertainties, interest rate fluctuations, geopolitical strife, and currency exchange rates will continue to influence the global dairy market, potentially leading to further shifts in the Global Dairy Top 20 rankings.

For full report click here:

Global Dairy Top 20: Lower

commodity prices impede revenue

gains