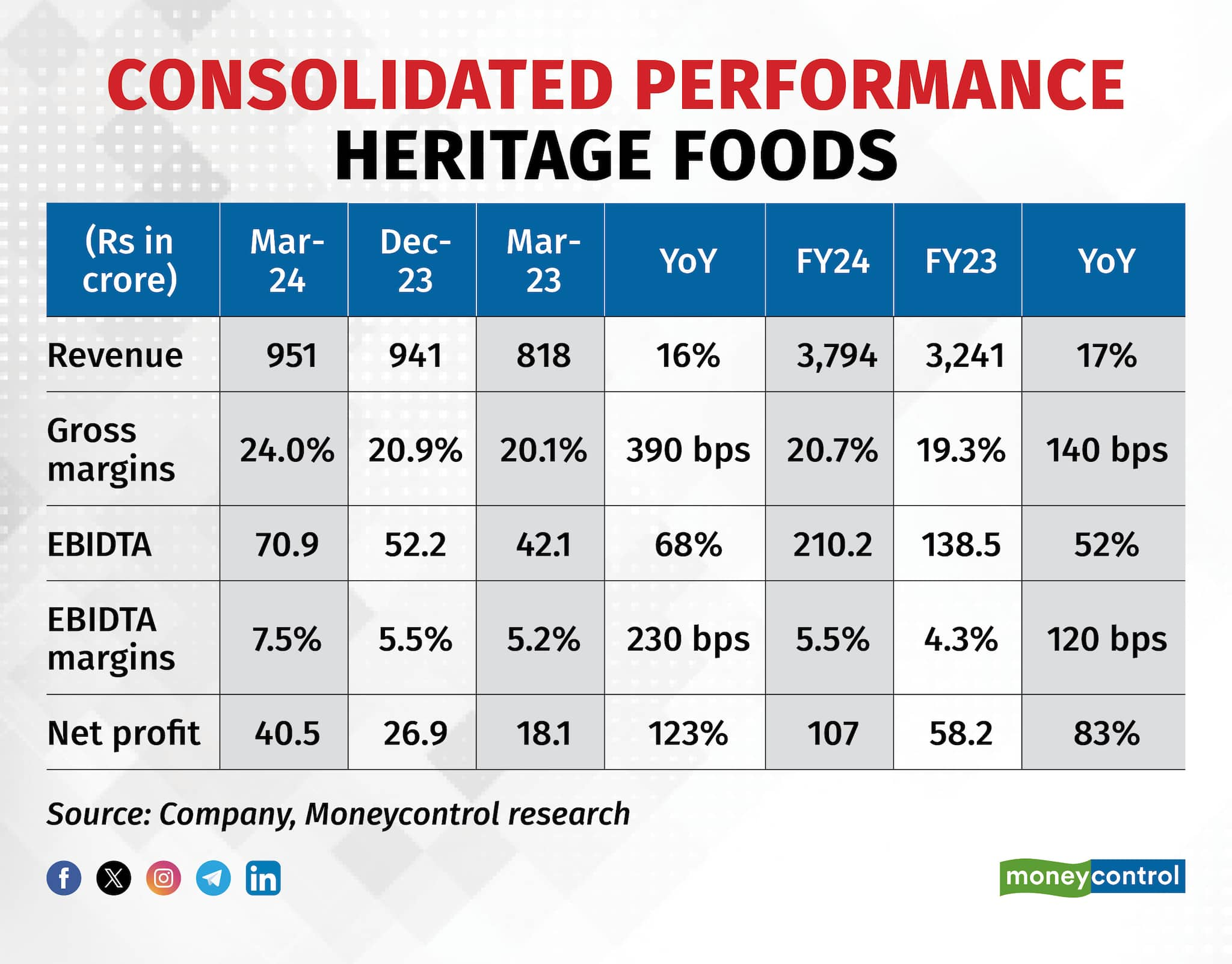

Heritage Foods (CMP: Rs. 626, Market Capitalisation: Rs. 5,814 crores, Under-weight), a leading dairy company with a diversified product portfolio that includes milk and milk-based products, posted a healthy revenue growth of 16 percent year on year (YoY) in the fourth quarter. This was primarily aided by a 20 percent increase in the volume of value-added products (VAP). The EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation) margins improved by 230 basis points to 7.5 percent, on account of lower fat inventory losses, benign raw material costs, and a richer product mix.

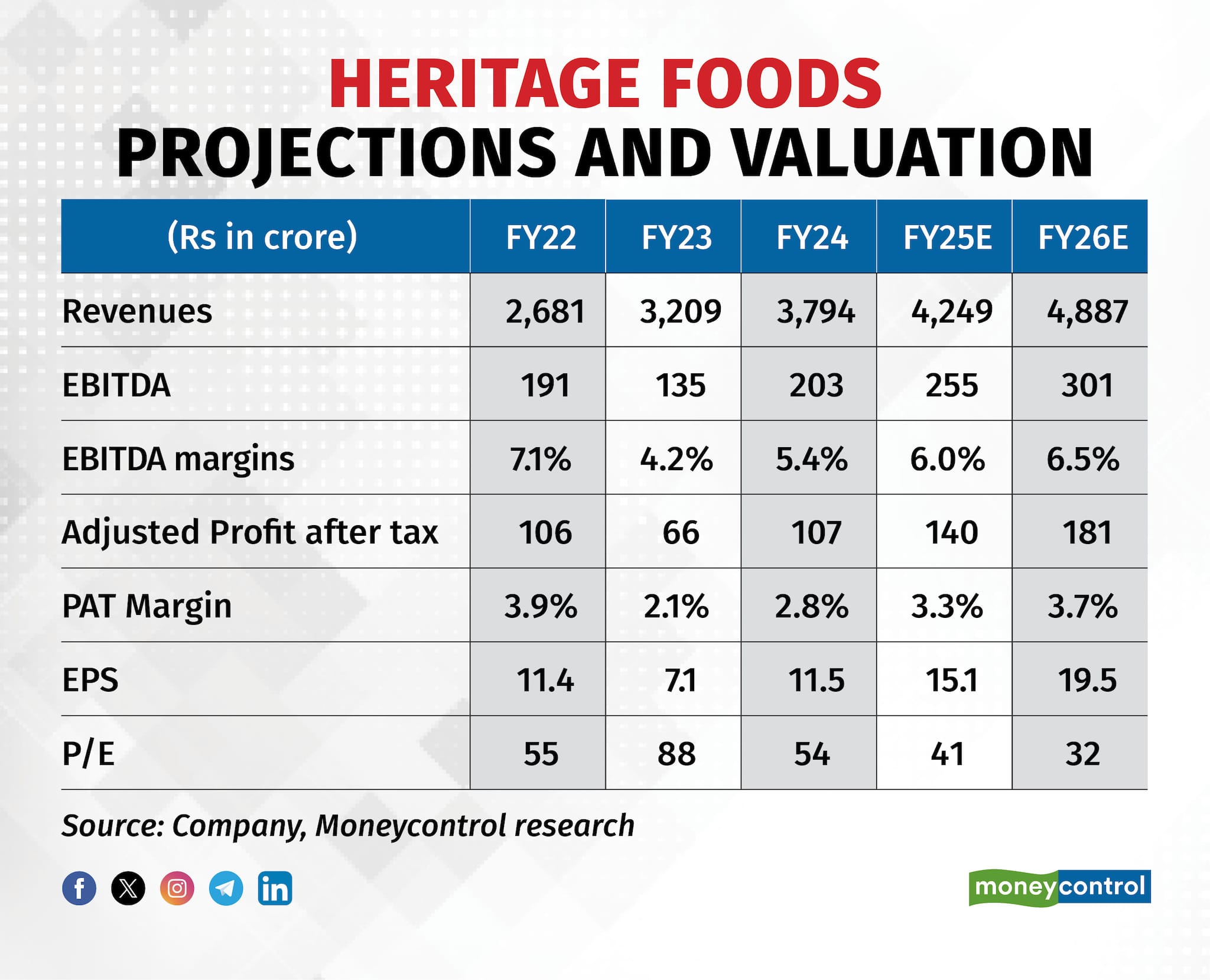

The company has set a target of reaching a revenue of Rs 6,000 crore in the next 3-4 years, which translates into an annualised growth of 15-18 percent. The management is focusing on increasing the share of VAP, penetrating new geographies, strengthening the supply chain, and expanding its product portfolio to scale up its market presence.

Robust operational performance

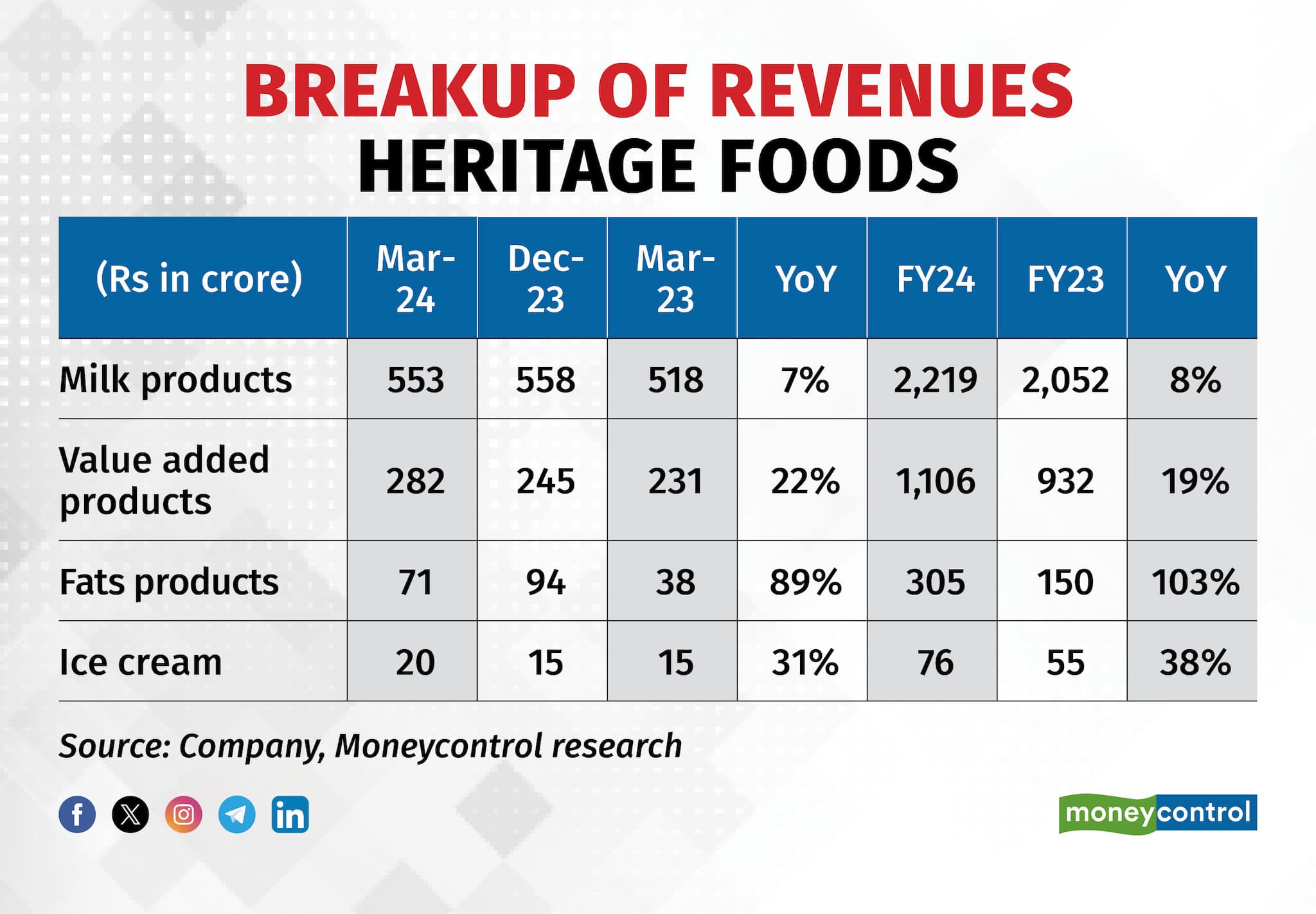

Milk revenues grew 7 percent YoY, driven by a healthy combination of higher sales volume and improved realisations. Average milk procurement increased by 11 percent to reach 1.59 million litres per day (MLPD) whereas procurement prices fell by Rs. 3.5 per litre to Rs. 41.7 per litre. The company posted robust performance despite the fourth quarter being the end of the flush season. Going forward, procurement prices are expected to remain stable or see a slight increase in Q1FY25.

Revenue from VAP grew much faster at 22 percent YoY in Q4 and 19 percent for the full year. The segment margins came in around ~10.5 percent. During the quarter, the company launched various products, including toned and skimmed milk in tetrapak under the brand names Farm Fresh and Lite Fit; a new ice cream variant Vibez; and flavoured curd under the brand name Shubh Meetha Dahi.

Milk procurement outpaced sales volume, resulting in bulk fat accumulation after a very strong flush season. Therefore, Heritage suffered a loss of Rs 13.5 crore (Rs 46.5 crore for FY24) due to fat inventory liquidation. The narrowing of the gap between milk procurement and sales volume should lead to a reduction in losses related to fat inventory.

Strong focus on distribution

Heritage is aggressively expanding its footprint in Maharashtra and Delhi NCR in terms of modern trade channels. These non-south geographies constitute 10 percent of revenue. The company is also strengthening its presence in its core markets (Tamil Nadu, Telangana, Andhra Pradesh etc.). Overall, Heritage added over 400 milk distributors, and more than 30 VAP distributors in the fourth quarter.

Improving operational efficiency

The share of VAP is on a steady uptrend, accounting for nearly 30 percent of the top line. The management expects this figure to reach 40 percent in the next 3-4 years. Rising contribution from VAP will amplify margin improvements as the segment operating margins are nearly 1.5-2 times higher compared to milk. Additionally, Heritage is actively pursuing various strategic initiatives to rationalise the cost base.

Outlook and Valuations

The market capitalisation of Heritage Foods, a family-run business led by TDP leader Chandrababu Naidu’s family, has skyrocketed post the announcement of election results. The stock is up ~70 percent in the last one month and now trades at 32x on FY26 estimated earnings. The stock is in deep overbought territory based on technical parameters and remains prone to a sharp pullback. We remain optimistic on the growth trajectory of the business but advise investors to book profits on account of the steep run-up in the stock price.

Source: Money Control